vermont income tax refund

All Forms and Instructions. IN-111 Vermont Income Tax Return.

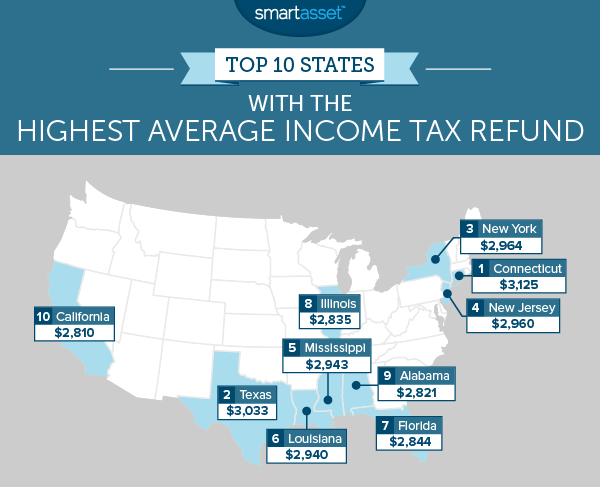

The Average Tax Refund In Every State Smartasset

Processing Time and Refund Information.

. W-4VT Employees Withholding Allowance. You can learn more about how the Illinois income tax compares to other states income taxes by visiting our map of income taxes by state. The Illinois income tax was lowered from 5 to 375 in 2015.

B-2 Notice of Change. Fact Sheets and Guides. PA-1 Special Power of Attorney.

Illinois maximum marginal income tax rate is the 1st highest in the United States ranking directly below Illinois.

Irs Owes Taxpayers More Than 1 Billion In Unclaimed Tax Refunds Tax Refund Income Tax Return Irs

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Education Tax Credits And Deductions Can You Claim It Tax Credits Educational Infographic Education

State Corporate Income Tax Rates And Brackets Tax Foundation

Tax Credit Tax Credits Tax Help Tax

How Is Tax Liability Calculated Common Tax Questions Answered

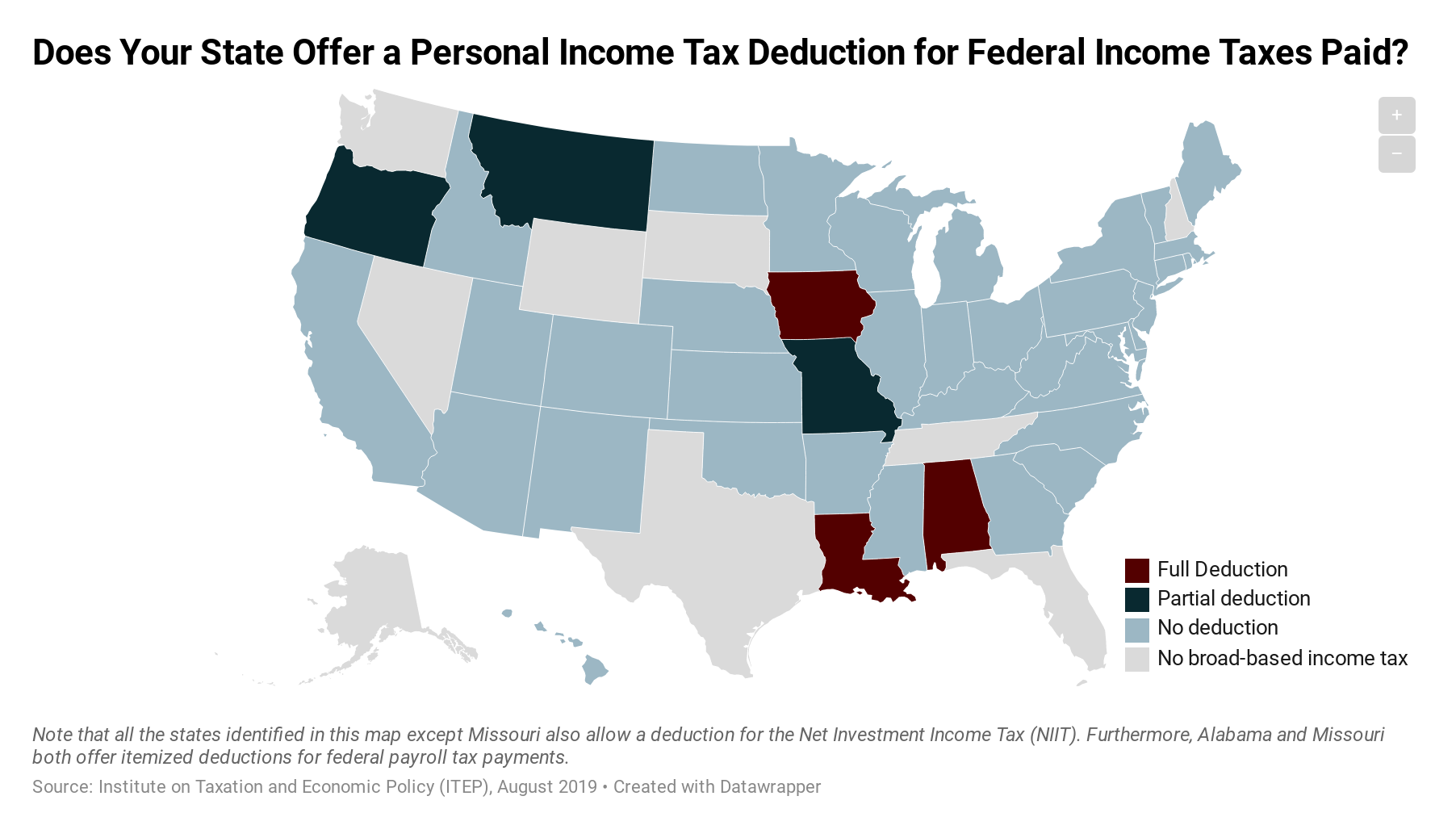

Which States Allow Deductions For Federal Income Taxes Paid Itep

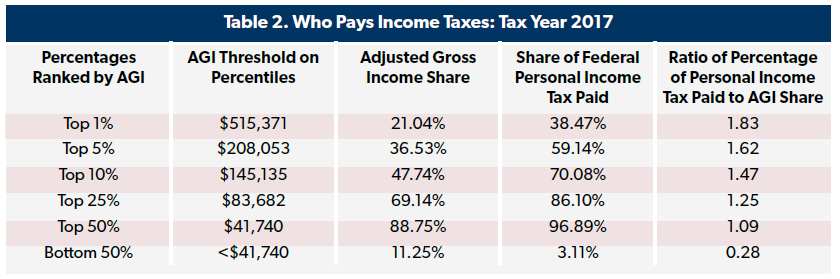

Who Pays Income Taxes Tax Year 2018 Foundation National Taxpayers Union

Where S My State Refund Track Your Refund In Every State

State Income Tax Rates Highest Lowest 2021 Changes

Personal Income Tax Department Of Taxes

Vermont Tax Forms And Instructions For 2021 Form In 111

Jansport Virginia Tech Shirt Tech Shirt Jansport Shirts

Tax Prep Tax Preparation Income Tax Preparation

The Average Tax Refund In Every State Smartasset

Jordan Weissmann On Twitter Cbo Just Released Its New 15 Min Wage Analysis Adds 58b To The Deficit Kills 1 4m Jobs Have T Budgeting No Response Senate

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine